Racing the Tariffs: How The Election Sparked a Surge in Auto and Durable Goods Spending in Q4 2024

It wasn't just people you saw - the USA went on an auto and durable spending spree in the fourth quarter of 2024, increasing GDP, inflation, and leaving us with low auto inventories.

Summary

In Q4 2024 auto sales spiked 7%, with spending on durable goods picking up from between 3% and 24%. Since auto lending standards net tightened, this is likely from anticipated tariffs.

This spending on durables showed up in GDP, with durables driving 37% of real GDP and being the main increase in nominal PCE, with auto inflation up 6.6%.

As the United States approaches a trade war with autos particularly exposed, auto inventories remain weak and have recently fallen.

If consumers were already anticipating price increases, businesses are as well, and most price increases happen at the beginning of the year.

Article

It started right after the election - people I know who knew politics and macroeconomics (and had some means) said they might go ahead and buy a car to get ahead of the upcoming Trump tariffs. Friends and colleagues were also hearing similar stories. The plural of anecdote is not data, but I did wonder if these stories might show up in 4th quarter GDP.

Sure enough, it did. The BEA keeps good records of the number of cars sold in the country:

Prior to the election vehicle sales were pretty stable over the previous year and a half. In November and December of 2024 they jump 7 percent, an extra 188,500 vehicles than we’d expect (and an extra 1.13 million annualized).

Does a spending binge show up in durables, defined as goods that can be stored and have an average life of at least three years, more broadly? Yes, it does, which makes sense because those goods are all at risk from tariffs.

We can look at real GDP growth, which was 2.3 percent annualized in the preliminary estimates of the 4th quarter.1 Let’s break it down by durables, the rest of consumer spending, and then everything else:

Much of the commentary on the GDP number last week focused on the strong consumer demand. However within that demand was a strong proportion in durable goods. 37 percent of GDP growth came from durables, which contributed 0.85 percentage points to GDP.

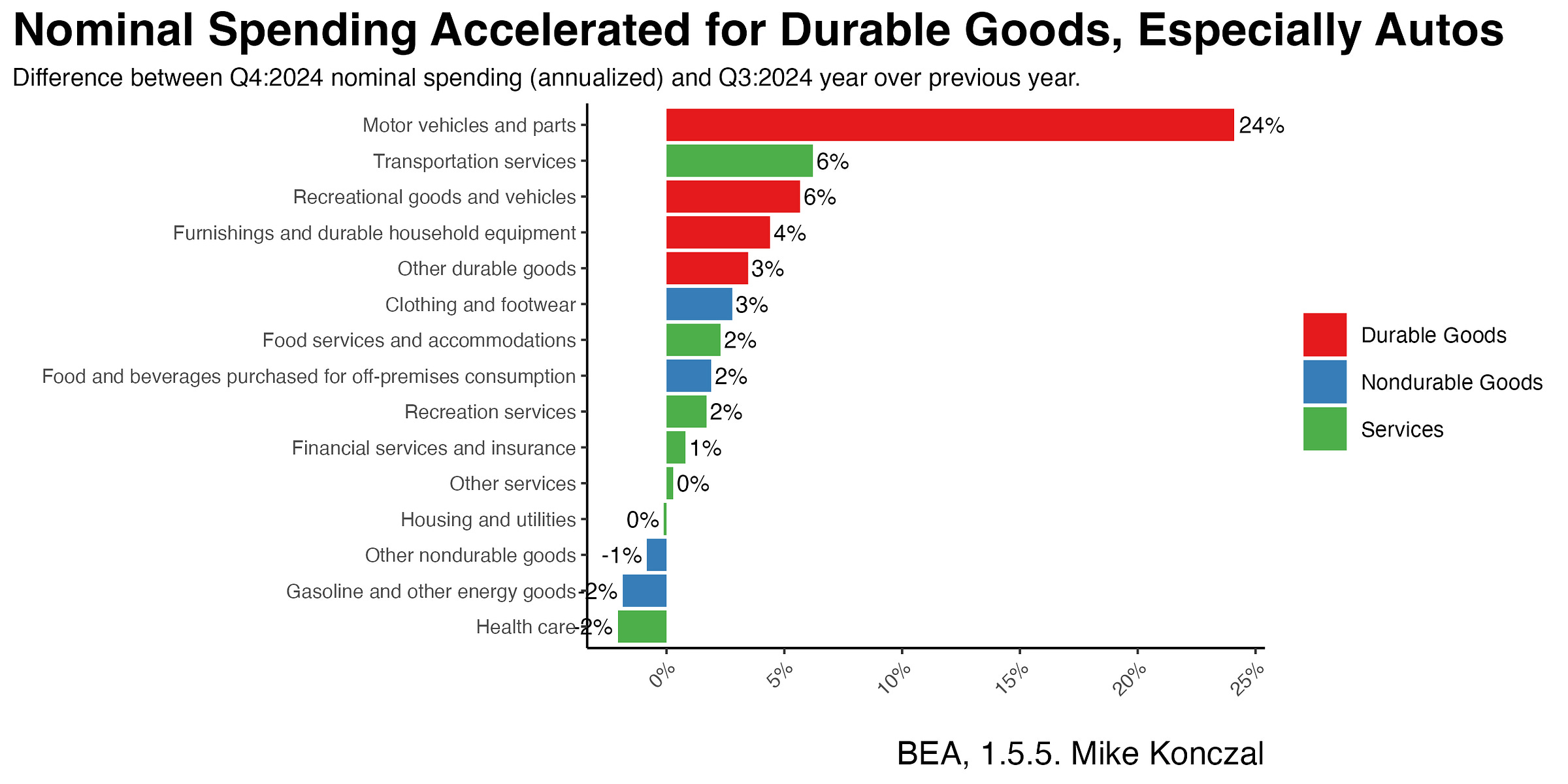

Now perhaps we’re spending so wildly because everyone expects to get rich under President Trump. If that’s the case we should see nominal spending broadly across categories. But that’s not the case. The spending is quite concentrated in the autos and other durables category:

I want to stick with nominal spending here, since that’s what people are actually doing. Above is the how much nominal spending picked up2 for each of the major expenditure categories. As we see, durables drive it, with the notable exception of potentially tariffs exposed transportation services.

I also want to look at nominal spending because inflation might be picking up already as a response. We can see that motor vehicles and parts inflation jumped an annualized 6.6 percent in the fourth quarter, which is particularly notable since it had been declining over the previous year and a half. We’re already seeing the impact of Trump’s policies even before he takes office.3

Two Takeaways

This is a classic problem in econometrics, where the outcome precedes the treatment, and it will complicate some of our analysis of what happens this year.

But there are two bigger takeaways. First is that if consumers are anticipating tariffs and changing their behavior even before Trump really settles into office, and especially before the extent of his trade war ambitions within North America and elsewhere, then businesses likely are too. So we will likely see a lot of anticipatory price increases in the beginning of 2025, when most price increases happen.

Second, the trade war with Canada and Mexico looks like it will hit auto production quite hard. And given people have already been buying cars like crazy there isn’t a lot of inventory to deal with. Here’s the auto inventories versus sales ratio. This fell dramatically during the supply side crisis of 2021 and only barely built back up. It’s fallen in recent months and could easily fall more if production stops.

I’ve seen the game theory models of bank runs. Do we need them for durables in advance of a trade war?

After I drafted this piece I saw that Dean Baker, at his substack, also caught the durable driver in the GDP numbers and linked it with Trump’s upcoming tariffs.

This is the 4th quarter increase annualized, subtracting the Q3 2024 to Q3 2023 increase. This is robust to other measures.

Note that this isn’t because auto loans or interest rates have become more favorable for borrowing since the election. Interest rates are up, mortgage rates are up, and while auto loan data isn’t easy we see from the Federal Reserve survey that the number of domestic banks tightening standards for auto loans increased in the fourth quarter.