Republicans Revive the “Lucky Ducky” War with 2025 Tax Plan

Congressional Republicans and President Trump are proposing a tax bill that looks like previous deficit-increasing tax cuts, but uniquely targets the poorest Americans.

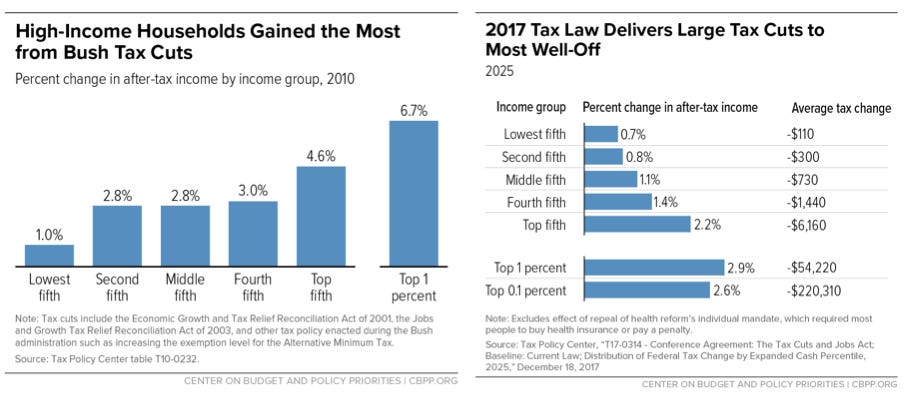

Consider three major Republican tax cuts from this century: (1) the George W. Bush cuts of 2001 and 2003, (2) Trump’s TCJA of 2017, and (3) the 2025 proposed Big Beautiful Bill (BBB) tax cuts working their way through Congress. All three massively increase the deficit by lowering taxes disproportionately for the wealthiest, throwing off any kind of long-term balance of revenues and spending.

But there’s something new this time. Let’s compare distributional tables:

As you can see, previous tax cuts showed the smallest gains in after-tax income for the bottom quintile, in dollar amount and percentage, compared to much larger gains for higher-income groups. That’s not controversial. But what people would fight about is what to take away from it. Liberals argue this is regressive; conservatives counter, pointing out that everyone’s taxes went down and that this is the direct result of progressive taxation. It generates a lot of discourse.

But here are the distributional tables for the proposed BBB working its way through Congress:

Even though conservatives are still blowing out the deficit, this time they aren’t even bothering to bring everyone along. Instead, those at the bottom are outright worse off. The cuts to spending programs, especially Medicaid and SNAP, are severe. Estimates suggest at least the bottom two quintiles, 40%+ of Americans, will experience a clear loss in income. This isn't a subtle debate over which basis to judge the proportionality of tax cuts: millions will simply have less money, even as the bill adds $3.8 trillion to the deficit.

And this does not even include tariff revenues. We know that tariffs will fall disproportionately on lower-income Americans. They spend more of their money in general and more of their money on goods. Estimates vary, but we could see tariff revenue landing between $270 and $450 billion a year, so upwards of 1.5% of GDP. Tariffs at this level function effectively like a consumption tax on imported goods, but instead of doing things that benefit everyone, this broadly borne tax is going to fund very regressive tax cuts.

Between direct spending changes and tariff impacts, the bottom half of Americans will become poorer while the deficit explodes. Why would Republicans embrace this?

As has been well documented, the thin majority in the House means that there are a ton of veto points, and those who want more cuts and those who want less of an increase in the deficit are using poor and working people’s lives as bargaining chips. There are numerous conflicting justifications being given for the tariffs, from revenue to strategy to compensation for being the world’s global currency.

Lucky Ducky

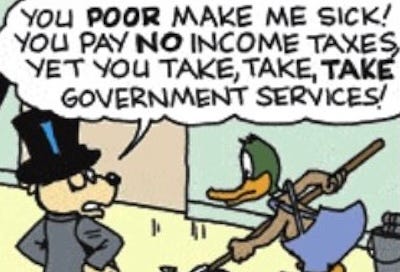

But at the risk of Boomer-ing out, I’m going to suggest an important element comes from something I and all other economic blog readers remember from 2002. Back then, the Wall Street Journal published a criticism of the proposed Bush tax cuts, in an infamous op-ed piece called The Non-Taxpaying Class (my bold):

But as the Republicans construct their tax plan, there is a large and under-appreciated fact they would do well to keep in mind. Over the past decade or so, fewer and fewer Americans have been paying income taxes and still fewer have been paying a significant percentage of income in taxes. […]

Who are these lucky duckies? They are the beneficiaries of tax policies that have expanded the personal exemption and standard deduction and targeted certain voter groups by introducing a welter of tax credits for things like child care and education. When these escape hatches are figured against income, the result is either a zero liability or a liability that represents a tiny percentage of income.

“Lucky Ducky” became a meme at the time, popularized by the cartoonist Ruben Bolling. The notion that the bottom half of income earners were politically suspect because they paid no income taxes, and they needed to be paying more in taxes even as taxes came down for the top half, showed up from time to time, but was rarely spoken out loud outside conservative think tanks and private donor meetings.1 I expected it to be buried in the Trump years, with his right-wing populism and appeals to working people. But apparently not.

This tax and tariff plan is what you’d propose if your goal was to wage war on the lucky duckies. The law doesn’t do the politically radioactive thing that the Wall Street Journal wanted, which is directly raising income taxes on low earners while cutting them for high earners. Instead, it opts for their second-best policies of a stealth consumption tax through tariffs and cuts to essential social and income insurance. But the effect is the same. It causes immediate suffering while making the big long-term challenges we face - inequality, security, revenues - all worse.

From simpler times, Mitt Romney on a secret camera at a fundraiser while running for President in 2012: “There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this president no matter what…These are people who pay no income tax.”

David Stockman chased the elusive "road runner" of cutting taxes and regulations and "welfare" and all the rest of the nasty entitlements like SSI and medicare and medicaid to no avail. Indeed, he later admitted that "democracy" undid the grand plans of the Reagan revolution and slammed its ilk into the proverbial wall.

Thanks to great resources such as Rortybomb the truth of the latest attempts to circumvent the favor of the majority are revealed in detail--Konczal's specialty.

We must admit though that this round of invasion by libertarianism is truly schooled in subversion and stealth and promulgates lies without impunity and is unimpeded in its corruption thanks to a rapidly eroding ethical tradition. The fight is truly on! It is lost without this kind of truth!